Content

While CPAs could enter appreciation into the accounting ledger they will use a separate sub-account, thus keeping the original cost and appreciation separate. Using two accounts the balance sheet shows the original cost and appreciation on separate lines, providing transparency. These represent the resources owned or controlled by the organization, such as cash, accounts receivable, inventory, investments, property, and equipment. accounting for churches The Statement of Financial Position lists the organization’s assets in order of liquidity, with the most liquid assets appearing first. No matter what the organization is, and, yes, even with churches, there should always be some internal controls and safety measurements in place to prevent fraud. If financial responsibilities are assigned to multiple people, then there’s an invisible sense of accountability between employees.

- The balance sheet shows the for-profit’s assets, liabilities, and equity.

- A transaction like this actually has three disbursements, the checkbook, an expense account, and a liability account.

- If they are incomplete or not in a standard format (GAAP), you may not be considered a good lending candidate.

- Fund accounting is a specialized branch of accounting designed to track and manage the financial activities of non-profit organizations, including churches.

- Sorting out tithes, contributions, and donations and allocating capital for projects and events can become overwhelming if you don’t have professional help.

QuickBooks helps you track expenses by committee, program, or fund. You can also track your donations—how much you received, spent, and have left. Then, run financial reports to see exactly how business is doing. Obtaining properly prepared financial statements is an accounting best practice for all businesses, including churches and other non-profits.

Use a Professional Church Bookkeeping Service

Religiously, it is also one with the largest number of churches… If you operate a small church with few incomings and outgoings, you may want to handle the bookkeeping yourself with a simple spreadsheet or physical ledger. Labor laws apply to people who work for a church the same way https://www.bookstime.com/ they do for any professional organization. If you donate to a church, a bookkeeper will write down the exact amount in a logbook or ledger along with the date of the donation and your name. Allow members to update their data, contribute online or register for events by themselves.

How the Employee Retention Tax Credit Became a Magnet for Fraud – The New York Times

How the Employee Retention Tax Credit Became a Magnet for Fraud.

Posted: Fri, 26 May 2023 09:16:54 GMT [source]

Its $4.99-per-month Deluxe plan is a desktop app for Windows and Mac with a mobile companion for iOS or Android devices. Realm offers 30 customizable church- and ministry-specific report templates. You can save predefined church reports in the Realm ministry management software, then customize them and save them for reuse. Finally, Realm’s church accounting and payroll reporting software allows churches to select standard accounting reports, then customize them based on time periods, funds, core accounts and departments. The for-profit accounting system’s balance sheets are equivalent to nonprofit organizations’ statements of financial position. The balance sheet shows the for-profit’s assets, liabilities, and equity.

Don’t Forget Church Accounting Software Reviews ????

Wave Accounting is best for very small churches with zero budget to cover accounting software. QuickBooks for Church offers the ability to tag donor dollars for a committee, program or worship fund. The restricted fund dashboard gives the name of the donor, the ministry or project the donation is intended for, the donor’s contact information and the donation amount.

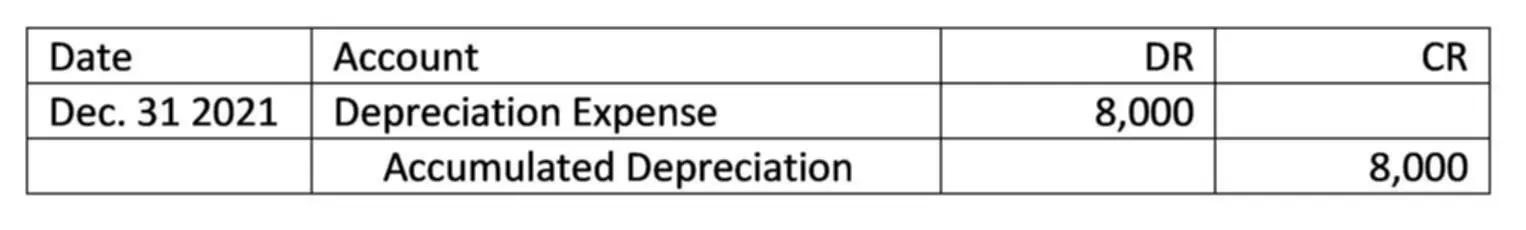

After entering transactions into the checkbook they would have to go update the spreadsheet to get a report for the month-end meeting. By Maintaining designated donor funds the church ensures transparency, accountability and honesty. Beyond these important values, there’s also the FASB requirement that states, churches must keep designated monies separate from the undesignated monies. FASB (Financial Accounting Standard Board) is the organization that issues accounting standards that all government entities like the SEC, IRS and so on follow. A long-standing accounting principle is to report the ‘cost’ of a fixed asset such as a building.

Best for Church Project Financial Planning and Tracking

That’s why paying a virtual assistant for their bookkeeping services—and only the bookkeeping services—can be such a wise investment. It’s a fair, equitable arrangement that helps you get the most out of your bookkeeping. And for the virtual assistant, it provides a stable, flexible source of income. Simply put, hiring a virtual assistant is going to be more cost-flexible than hiring a full-time bookkeeper. A virtual assistant with bookkeeping experience, however, can turn things around.

Even when restrictions aren’t placed on the contributions, they should all be reinvested back into making your organization better and more impactful. This ensures your organization is remaining respectful and responsible with the funds generously given to your church. Let’s start from the very beginning with a definition of church accounting. This will help make sure we’re all starting with the same foundations on the topic before diving deeper.

Make Year-End Giving Statements

For this reason, you need church accounting software designed to handle fund accounting. Extra benefits in a platform include giving tools and presenting your data concisely to those who have given. When it comes to filing with the IRS each year, churches can often have some of the most complicated returns out there. This is due to the rules around reporting revenue and expenses for 501(c)3 organizations. Any money that enters the church needs to reflect on the organization’s tax forms in some way. For example, some people give money every month, and others give once or give in-kind contributions.

- By doing so you make it easier to create budget reports and income-expense statements.

- Unlike for-profit businesses, churches don’t exist to make a profit.

- Embrace effortless financial management with a user-friendly interface, specialized features, and dedicated customer support.

- Also, list extra financial capabilities your church needs, such as the ability to process payroll, maintain a CRM or categorize restricted funds.

- There are many accounting software solutions that can handle fund accounting.

- Church accounting is the organization, recording, and planning of finances for churches.

However, the IRS requires that every sum received over $250 must be publicly acknowledged and reported. Every month, set out your logs and carefully reconcile the transactions contained in them. Similarly, when the church disburses its own money, a bookkeeper will make a note of the outgoing in the logbook. That’s why most of them these days employ bookkeepers, who are there to keep tabs on the religious body’s financial incomings and outgoings. Additionally, the organization needs to ensure the fund used on the return is also the same fund as the original purchase transaction.

Craft a fundraising plan

Because this is an asset account, this mistake carries forward on the books into all future years. Other mistakes like #7, the church simply opens up another checkbook not realizing what that really means. Most of the time the church board is trying to solve an immediate need of keeping money separated and not looking at the long-term issues. In creative accounting, only one line item is used- the fixed asset.

The best accounting software programs all provide similar features, so when considering which one is best for your business, you need to consider which features are the most important to your situation. This will help you decide which accounting software meets your needs best. Other features you may want to consider include whether the software has a mobile app, how good its customer service is and how well it does with accounts receivable (A/R) and financial reporting. Bookkeeping means recording these actions to allow churches to easily pull reports to inform donors and the government on their financial history. It focuses on the organization’s revenues, expenses, and the net change in its assets over that period. The primary purpose of this report is to provide a transparent and detailed overview of an organization’s financial activities, emphasizing how they align with the mission and objectives.

Sync your church accounting software with apps that help you communicate with donors and manage contributions with ease. ZipBooks has all of the features you need in a church accounting software without the hassle of annual licenses or complicated spreadsheets. We designed ZipBooks to be intuitive for anyone to use, whether you’re a millennial or have decades of service under your belt.

- Church accounting is quite different than its counterpart, for-profit accounting.

- This ledger is self-balancing and keeps track of all financial transactions for the company.

- Churches wanting to gain an understanding of and engage a large body of parishioners and donors can add a CRM.

- To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

- Outsourcing some of the work in preparing for tax filings helps reduce this stress.

This way, church members know exactly where their tithes and gifts are going. Whenever it comes to money, organizations should put in place internal controls to correctly account for the money. Particularly when smaller churches don’t have a large number of volunteers.